Published on

Correos Spain shares information on EU regulations

EAD is the key pillar to strengthening the security of the postal network, facilitating customs clearance and fiscal (VAT) processes, and providing a good customer experience.

Changes in the EU regulations on security (ICS2) and VAT process which took place in 2021 reaffirmed that, all postal operators sending items internationally must transmit Electronic Advance Data (EAD) for security reasons and in order to speed up customs clearance and delivery at destination. These changes are valid for all EU member states and affect EMS members that send goods to the EU.

To support members in complying with import security and customs legislation, the EMS Cooperative is holding meetings where members can share experiences on how postal operators are adapting to the EU regulations changes to VAT and the Import Control System 2 (ICS2). In March 2022, over 132 participants from Asia Pacific and Europe took part in the first meeting and shared their experiences both as exporters to the EU as well as from the perspective of EU members.

The EMS Cooperative asked Cristina Cuerda-Albaladejo, from Correos Spain, to share her views on the EU Regulations changes and give recommendations to EMS members.

Cristina Cuerda-Albaladejo (Correos, Spain) shares her thoughts on the EU regulation changes.

“Two years since the outset of the pandemic, restrictions caused by COVID-19 still have a strong impact on the postal sector and its supply chain.

The Postal sector can overcome the challenges ahead due to two key factors: the proven resilience of the postal network and the digitalization process started prior to the pandemic, paving the way for implementing the Electronic Advance Data (EAD).

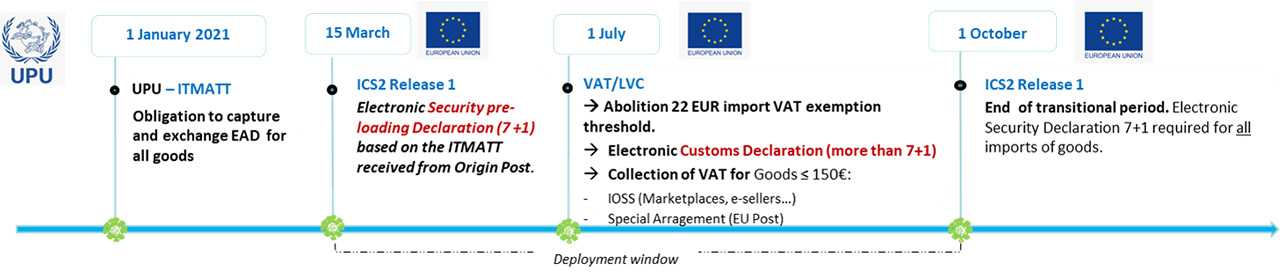

Meanwhile, the year 2021 marked the kick-off of new security/customs requirements at the global and EU levels:

- UPU mandatory provision of EAD for items containing goods using the Item attribute (ITMATT) message from 1st January onwards,

- EU requirements for items containing goods entering Europe: the Post of origin is required to provide information on the content of the postal item in advance using ITMATT message format to comply with European legislation,

- ICS2: security declaration data elements to strengthen the security and safety of the goods entering the EU,

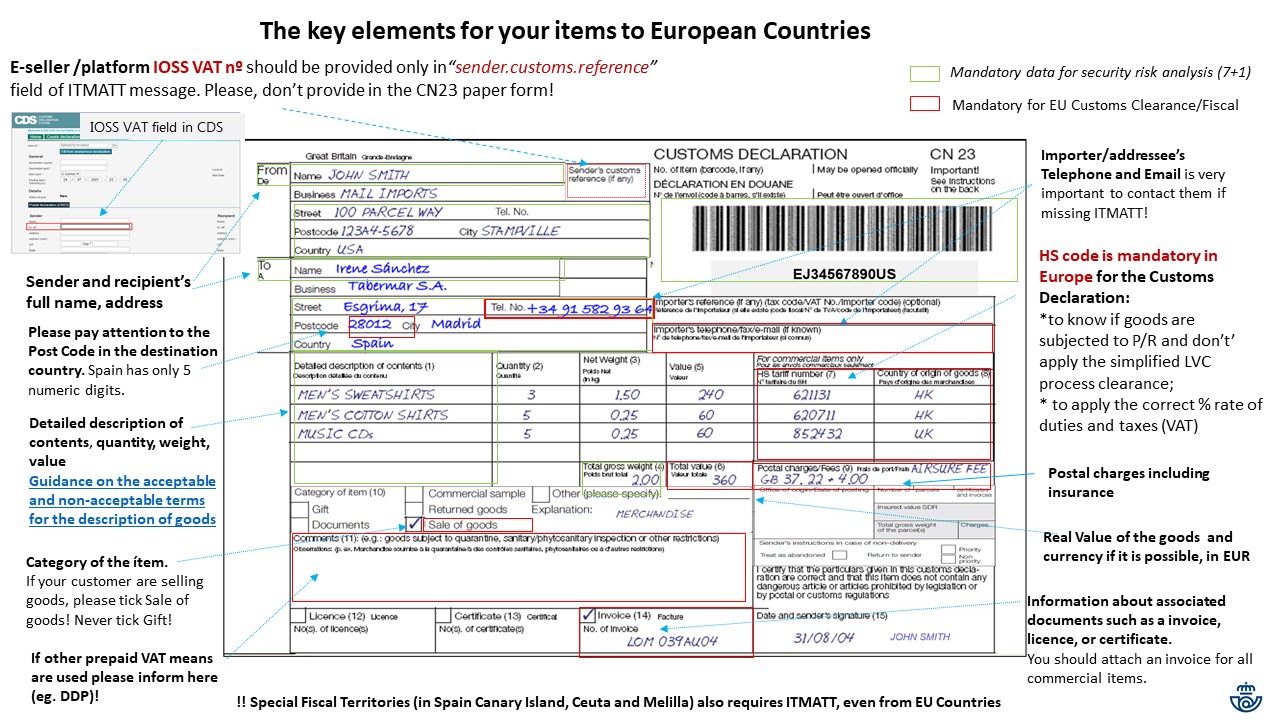

- VAT e-commerce package: to address VAT fraud, include an Import Customs/fiscal Declaration together with security declaration data elements and the Harmonized System code which is mandatory in Europe. If VAT is already paid for, the Import One Stop Shop identifier (IOSS ID) is needed, IOSS ID on the Customs sender reference field.

Five questions to help understand how EMS flows can meet EU regulations on Security (ICS2) and the VAT (import/fiscal) process:

Why is EAD important?

EAD is the key pillar to strengthening the security of the postal network, facilitating customs clearance and fiscal (VAT) processes, and providing a good customer experience.

Who is responsible for providing EAD?

The Post of origin is responsible for

- providing good quality content of the postal items’ data information to the destination EU Post which has to comply with import security and customs legislation.

The destination EU Post is responsible for:

- providing the electronic Security Declaration to the European Customs Authorities,

- providing the electronic Import Customs/fiscal Declaration to the National Customs Authorities

When will the data be used?

- Before sending the items physically to the EU, the EU Customs authorities will make the security risk analysis using the reduced data set from the ITMATT advanced by the country of origin, to authorize the entry of the postal item into Europe (Pre-loading Advance Cargo Information Security Declaration for).

- Upon arrival of items to the EU country, if goods have received the authorization from the destination customs to enter Europe, the EU Postal Operator will perform the customs import clearance process using the whole ITMATT received in advance according to EU rules (Import Customs Declaration)

Where is data to be used throughout the process?

ITMATT data will be exchanged between the origin and destination posts. UPU members can either use the Customs Declaration System provided by the Postal Technology Centre (PTC) or ad-hoc systems to capture and transmit data.

What is the impact of missing content information or with poor quality information data?

Missing data can have a strong impact on the postal network and cause issues for our customers, for example:

- Goods missing ITMATT or with poor information could be considered non-compliant items according to regulations and EU Post could return items back to origin.

- Items can be retained in Temporary Storage from the moment of arrival in the destination EU country which will generate extra operational costs, such as capturing data upon arrival, manual treatment, coping with customs bottlenecks, delays in delivery, double taxation if IOSS is not provided correctly etc.

EU posts are fully dependent on non-EU posts compliance and partner's readiness. Only by working together can we further speed up the flow of EMS into Europe for our customers."